Let’s be honest, getting someone to say “yes” to a credit card isn’t what it used to be. With more options, higher expectations, and smarter consumers, credit card acquisition today is less about volume and more about value. And the brands that win? They don’t just push products. They build journeys.

1. Strong Foundations Start with a Flexible Value Prop

The product still matters. But flashy rewards alone don’t cut it. Cardholders want flexibility—benefits that fit their lives, transparency on fees, and perks they can control. Think of it less like a one-size-fits-all card and more like a pick-your-perks experience.

Brands leading the pack are constantly refining their offering based on market feedback, competitor shifts, and behavioral data. They’re not just selling cards—they’re offering financial tools that adapt to people’s lives.

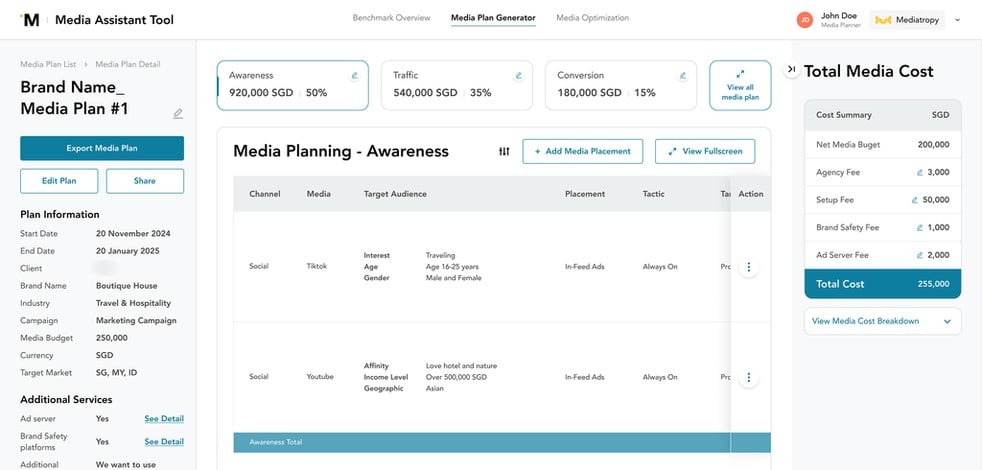

2. Budget Smarter: Invest in What Works (and What Might)

No more static marketing budgets. High-performing teams are embracing agile budgeting, carving out space for “sure bets” (like PPC and affiliate), but also giving themselves room to test new ideas—whether it’s AI-generated creatives or hyper-targeted TikTok ads.

It’s not just about CPA anymore. It’s about the long game: CAC vs. CLTV. Quality over quantity. Don’t just ask “How many leads did we get?” Ask, “How many of them became valuable customers?”

3. Segmentation: Go Deeper Than Demographics

The smartest marketers are digging below the surface. Instead of just targeting by age or income, they’re asking: What motivates this person? What are they worried about? What benefits will actually matter to them?

Think behavioural segments (frequent fliers, digital-first spenders), life stage targeting (new grads vs. credit rebuilders), or even values-based segments (eco-conscious spenders who want to plant trees with every swipe).

Lifecycle segmentation also plays a big role. Someone who starts with a secured card today could be a premium cardholder tomorrow—if we nurture them right.

4. Digital Marketing Strategy: Connect, Don’t Compartmentalise

Great acquisition doesn’t happen on a single channel, it’s a symphony. Each touchpoint supports the others, and the most effective strategies treat every interaction like a step in a larger narrative. Here’s how to amplify impact across the funnel:

- Paid Search: Still great for high-intent users, but expensive. Win by bidding on long-tail, high-conversion keywords (like “best cashback card for freelancers” instead of just “credit card”). Pair this with fast-loading, mobile-first landing pages that echo the ad copy. Use dynamic keyword insertion to boost relevance.

- Social Media: More than just an awareness tool. Use reels, stories, and short-form video for education and storytelling. Spark FOMO with limited-time offers. For Gen Z and Millennials, align your visuals and tone with platform-specific trends, think lo-fi TikToks over polished brand videos. Don’t underestimate social proof: showcase reviews and UGC.

- Influencer + Creator Marketing: Financial influencers (FinFluencers) bring credibility, especially in markets where trust in banks is low. Go beyond just paid shoutouts; co-create explainer content, Instagram Lives, or YouTube breakdowns of card benefits. Look for creators with high engagement over inflated follower counts.

- Affiliate Marketing: Treat affiliates like your extended sales team. Provide them with fresh content, optimized banners, and transparent reporting. Prioritize partnerships with comparison engines, credit education sites, and finance YouTubers. Consider incentivizing based on quality—e.g., activated accounts or CLTV, not just raw applications.

- Direct Mail: Yes, it still works. Especially when highly targeted. Use personalized mailers with dynamic QR codes that link to tailored landing pages. A/B test formats—letters vs. postcards vs. folded offers—and consider bundling with offline perks (e.g., dining vouchers or exclusive physical events).

- Email + In-App Messaging: These are your secret weapons for cross-selling and retention. Use behavioral triggers (e.g., frequent debit spenders with no credit product) to recommend cards that fit existing habits. Keep copy simple, CTA clear, and mobile formatting clean. Bonus: in-app can enable 1-click pre-filled applications.

- SEO + Content: The unsung hero. Focus content around intent-based queries like “how to build credit fast” or “is cashback better than travel points?” Use calculators, comparison tools, and blog series to educate and convert. Structure content to rank—H1s, schema, internal linking—and refresh high-performing articles quarterly.

Pro Tip: Map your media to your funnel. Paid search and SEO for intent. Social and influencers for awareness and consideration. Email and in-app for conversion and loyalty. When done right, each channel builds on the last—turning noise into narrative.

5. Creative: Where Data Meets Emotion

In a sea of sameness, creativity is your edge. What works? Calm, relatable imagery. Straightforward copy. Strong CTAs. And constant testing.

AI is helping us unpack what actually performs—from image tone to headline phrasing. It’s not just art, it’s science. And it’s changing the way we design every banner, every post, every ad.

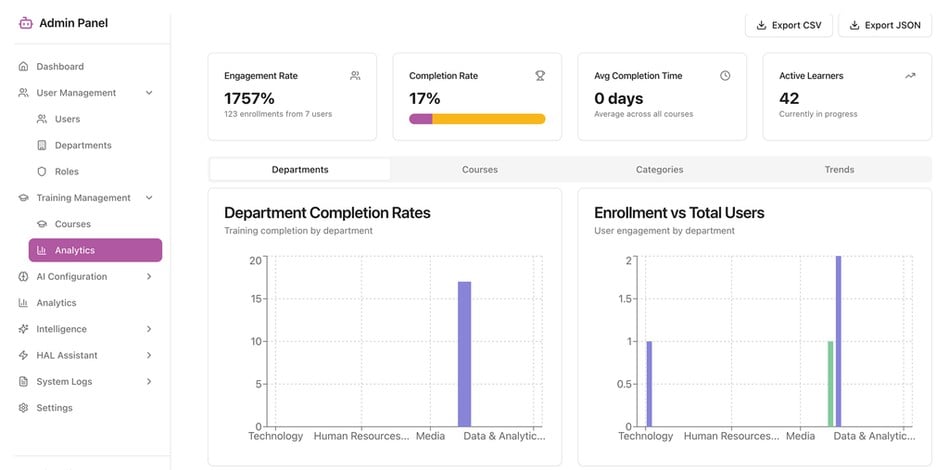

6. Metrics That Matter

Let’s cut through the noise. Here’s what top-performing marketers are tracking:

- CPA: Paid search averages around $81.93. Direct mail is higher per lead but wins on conversion.

- Conversion Rates: Facebook averages 8.25% for lead gen.

- ROI: SEO can return $22 for every $1 spent. Affiliate marketing? Up to $6.50 per $1.

- Content: Blogs with financial intent often see 13x ROI.

But CLTV is becoming the MVP—tying your efforts to long-term revenue, not just short-term wins.

7. Omnichannel Strategy: Make the Journey Make Sense

Your customer might start on Instagram, read a blog, see a retargeted ad, and apply via email. That’s not chaos—it’s reality. And the best marketers know how to connect the dots.

Omnichannel isn’t about being everywhere. It’s about being everywhere intentionally. The messaging aligns. The experience feels seamless. And attribution tells you what truly made the difference.

Our Final Word: The rules have changed and they’ll keep changing

Credit card acquisition isn’t about being loud. It’s about being relevant. The brands that thrive are those that treat acquisition like a relationship not a transaction.

But one thing remains constant: the need to put people at the heart of every acquisition effort. Stay curious, stay nimble, and above all, stay customer-obsessed. That’s how you win the next cardholder and the next.

At Mediatropy, we help financial brands transform touchpoints into trust, and applications into loyalty. Ready to reframe your strategy?

Let’s make it happen.

Discussion about this post